Prosper Centers

Prosper Tax Help

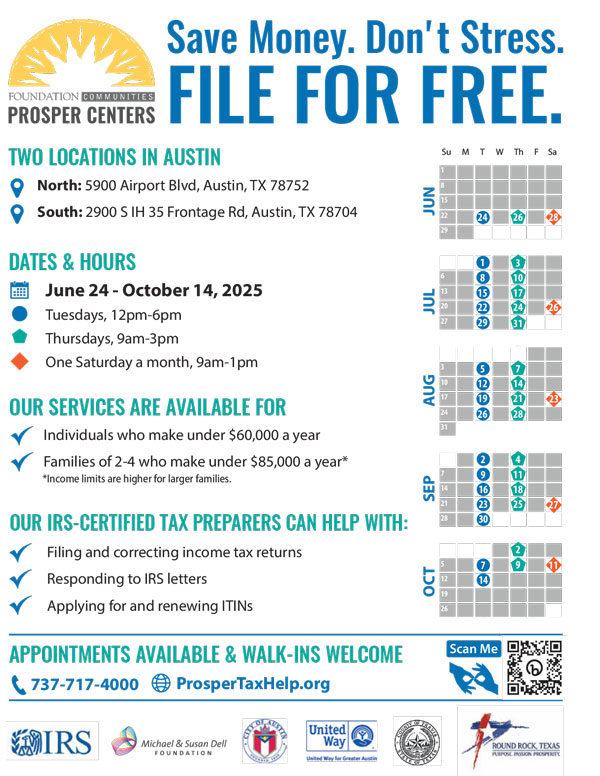

Prosper Tax Help is a

free service available to individuals who make less than $60,000/year and households of 2-4 that make less than $85,000/year. Income limit increases by $5,000 for each additional family member.

Our IRS-certified tax preparers provide free tax filing to thousands of community members each year, helping them get the maximum tax refund. We also help file prior year tax returns, respond to IRS letters, and complete ITIN applications.

If you are not eligible for our services, a list of other local tax preparation resources is available here.

Prosper Tax Help will be open from June 24th to October 14th for year-round services. Appointments can be scheduled using the appointment scheduler below. Click here to review our flyer with hours.

Auto-translation into other languages is available in settings.

Schedule an Appointment

Schedule your appointment with Prosper Tax Help below!

Locations

Prosper Center North

5900 Airport Blvd

Austin, TX 78752

Bus Routes: 7, 337, 350

Prosper Center South

2900 S I-35 Frontage Rd

Austin, TX 78704

Bus Route: 300

Hours:

In-Person and Walk-Ins Available

– Tuesdays 12pm – 6pm

– Thursdays 9am – 3pm

– One Saturday a month (6/28, 7/26, 8/23, 9/27, 10/11) 9am – 1pm

Tax Help Services

Peak Tax Season: January through April

- Income Tax Returns

- Applying for and renewing ITINs

- Tax returns from prior years

- Tax Amendments

- Responses from the IRS

Off Season: June through October

- Income Tax Returns

- Applying for and renewing ITINs

- Tax returns from prior years

- Tax Amendments

- Responses from the IRS

Closed/Out of Season

- Use our inquiry form for specific questions. We may still be able to assist you.

Can’t visit us in-person?

IRS Direct File

IRS Direct File is a free virtual filing option available to taxpayers in 25 participating states. This service is limited to simple federal tax returns for the 2025 filing season. Additional limitations may apply. To learn more or to get started, visit directfile.irs.gov.

MyFreeTaxes.com

MyFreeTaxes is a free filing option for those who earn less than $84,000 a year, created by national non-profit United Way. MyFreeTaxes guarantees 100% accurate returns with the maximum refund, and top of the line security. Visit MyFreeTaxes.com and select “File My Own Taxes” to self-file.

FAQs

Q: I didn't file my taxes last year or in the last couple of years. Can you help me file for this year and also for the last couple of years?

A: Yes! We can file for current and prior tax years. Please book a separate tax appointment for each tax year you need prepared.

Q: I was paid in cash and/or digital payments. Do I need to file my taxes?

A: Yes, income you receive must be reported on a tax return, even if received in cash or via digital payments (e.g., Venmo). Please schedule a tax preparation appointment and bring all documents and information about payments you received. We will help you correctly report your income on a tax return. Please note: the Tax Help program cannot prepare tax returns with cryptocurrency transactions, whether that be sales of cryptocurrency or income received in the form of crypto payments. In these cases,

please refer to this list of other options for tax return preparation.

Q: Which Individual Taxpayer Identification Numbers (ITINs) have expired and need to be renewed?

A. These ITINs must be renewed:

- ITINs with middle digits 70 to 88 that have not already been renewed

- ITINs with middle digits 90-99 that were issued before 2013 and have not already been renewed

- ITINs not used at least once on a tax return in the past three tax years (e.g. 2021, 2022, and 2023)

Q: I want to apply for an ITIN. How do I go about doing this?

A. ITINs are issued to eligible individuals as part of the tax filing process. The first step is to schedule a tax preparation appointment at any tax center location. At the conclusion of the appointment, an internal referral is submitted. The taxpayer receives a phone call within one week to schedule an appointment at Prosper Center North or Prosper Center South to prepare and submit the ITIN paperwork with the tax return.

Q: I got a letter from the IRS that I don't understand. Can you help with that?

A. Yes! Please schedule a tax preparation appointment and bring with you the IRS letter and a copy of the tax return referenced in the IRS letter (if applicable), as well as all tax paperwork you have available from that tax year. We will review the IRS letter with you and help you respond, provided it is within the scope of our services.

Q: I think I made a mistake on my tax return. Can you help with that?

A. Yes! Please schedule a tax preparation appointment and bring with you a copy of the tax return filed, all tax paperwork you have available from when you filed, and any information and/or documentation about the mistake you made. We will review your tax situation and help you file an amended tax return, provided it is within the scope of our services.

Q: My dependent is now in college or working. Can I still claim them as a dependent?

A. You may be able to claim a dependent who is in college or working; this is based on several factors. We can make this determination if you bring with you to your appointment the person’s Social Security card or ITIN letter and other information like their age, their total income for the year, and the sources of their support during the year. If the person is taking college classes, please also bring their school login credentials or their Form 1098-T and the account summary for each semester of the tax year.

Q: I'm a dependent on my parent’s/parents’ tax return but I worked last year. Do I need to file a tax return?

A. You may need to file a tax return. If you don’t have a filing requirement, it may still be beneficial to file a tax return to get a refund of any federal income taxes withheld from your paychecks during the year. We recommend you make a tax appointment with your parent(s) so we can review your paperwork together and make a determination of whether you must or should file.

Q: I did my taxes elsewhere. Can you review them to see if they are correct?

A. We can provide a very general review and summary of a tax return that was already filed. To know for sure if it was filed correctly, we can prepare the tax return in our software and compare it to the return that was already filed. We can then review any mistakes with you and prepare an amendment to correct them.

Q: What should I bring to my tax preparation appointment?

A. Please bring the following:

- Valid photo identification for you (and your spouse if filing jointly) and Social Security cards or ITIN letters for everyone on the tax return.

- Tax documents, such as W-2s and 1099s, a list of cash or checks received as income, and Social Security, retirement, and unemployment benefits.

- Documentation for expenses you paid during the year, such as child care, business expenses and miles driven for those who are self-employed, tuition and/or book costs for college classes, student loan interest paid, etc.

- If you own a home or are itemizing, bring documentation for your mortgage interest, property taxes, charitable donations, and receipts for out-of-pocket medical expenses you paid.

- Bank information (including routing and account number), if you would like to receive a direct deposit of a refund or pay a balance due by direct debit.

- A copy of the prior year’s tax return, if you have it.

For a more comprehensive checklist, click here.

Q: What other free resources are available for taxpayers experiencing a tax issue?

A. Here are two additional, free resources:

- If you are having tax problems and have not been able to resolve them with the IRS, Taxpayer Advocate Service may be able to help. Call 877-777-4778 and ask to speak with an intake advocate.

- If you need assistance navigating an IRS audit or exam, stopping a tax lien or levy, settling a tax debt, or resolving another tax issue, Texas Rio Grande Legal Aid (TRLA) may be able to help. Call the intake line at 888-988-9996.

Q: I’ve heard about the Earned Income Tax Credit (EITC). How can I know if I’m eligible?

A. The EITC is a refundable federal income tax credit for low-to-moderate income working individuals and families. When EITC exceeds the amount of taxes owed, it results in a tax refund to those who claim and qualify for the credit. Your eligibility for the EITC, and the amount you receive, will be automatically determined as part of the tax preparation process.

Testimonials

Posted: February 21, 2022

Don’t stress this tax season. Foundation Communities can help you maximize your refund free of charge! Why should you file with Foundation Communities this year? Here are the top five reasons to use our free tax filing assistance. 1. It’s free! The average cost of professional tax preparation ranges from $159 to $273. This is […]

Find us on Social Media!

Contact Us

To contact the Prosper Tax Help team with any questions, call 737-717-4000 or submit the inquiry form below. We will reach out as soon as possible. For inquiries about outreach presentations or events, please reach out to outreach@foundcom.org

Meet Our Staff

Janet Herrgesell, Tax Program Manager

Leti Valadez, Supervising Site Manager

Andy Liebler, Drop Off Program Manager

Catherine Cusick, Drop Off Program Manager

Gabriela Mordi, Senior Project Manager

![]()

![]()