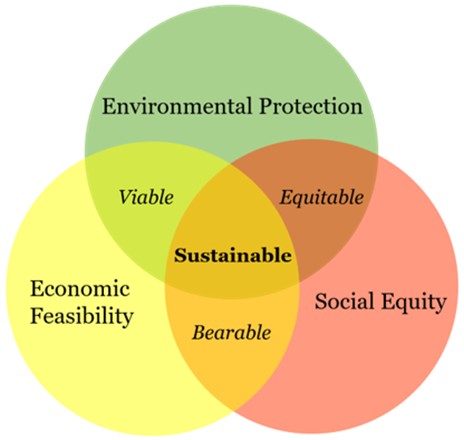

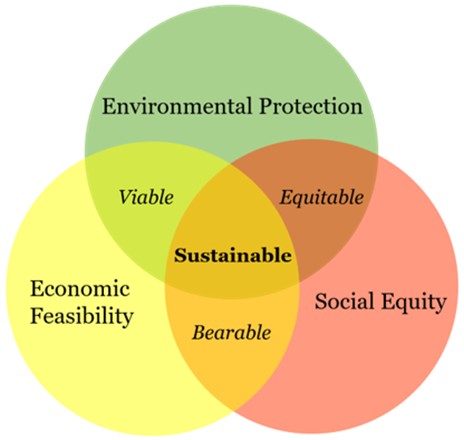

What Is Sustainability?

Sustainability is based on a simple principle: Everything that we need for our survival and well-being depends, either directly or indirectly, on our natural environment. Sustainability is the integration of environmental health, social equity and economic vitality to create thriving, healthy, diverse and resilient communities for this generation and generations to come.

We want to be able to meet the needs of our present without compromising the ability of future generations to meet their own needs.

What Drives Our Efforts?

The effects of climate change are all around us – waves of impact are affecting disadvantaged populations first and the strongest, though they contribute the least to global warming. We have all experienced more frequent and intense droughts, storms, and extreme temperatures, as well as related power outages.

Since the operations of man-made buildings account for nearly 30% of total national greenhouse gas emissions, Foundation Communities believes that as lifelong owners of our communities, it is our responsibility to make sustainable design and operating choices.

Foundation Communities has had an established Sustainability Department for nearly 15 years, so we have extensive experience integrating mindfulness, health, equity, and efficiency into our communities. We are a pioneer for sustainable affordable housing, and are involved on a local, regional, and national level with informing policies and programs that help encourage other low-income housing providers to greenify their portfolios.

* * * *

As we start Earth Day 2025, we want to share just a few of our organization-wide sustainability efforts:

– Greenhouse Gas Emissions: There are national and global efforts to encourage buildings owners across several industries to retrofit our built environment to promote energy efficiency. We are partners with the Department of Energy’s Better Climate Challenge, which commits us to a 50% reduction in carbon emissions over 10 years. Currently, we are sitting at a 36% reduction in greenhouse emissions from a 2017 baseline. We have been able to achieve this progress through a variety of carbon-saving initiatives including energy efficiency improvements, our vast solar portfolio, and the overall greening of the electric grid, as less of our energy is produced from coal and natural gas.

– Energy & Solar: We partnered with The Department of Energy for the Better Buildings Challenge, which commits us to a 20% reduction in energy use intensity over 10 years – we have achieved 18% so far! We use energy efficient design, incorporating LED lighting, tight building envelopes and insulation, as well as Energy Star rated windows and appliances. To top it off, we have one of the largest solar portfolios in Austin with panels generating 1.5 MW installed across 15 properties and another 500kW to be installed by the end of this year.

– Water: Foundation Communities has also committed to a 20% reduction in water use intensity over a 10 year period. Since we pay for water at nearly all of our low-income properties, the savings we see from the reduction in water consumption can be reinvested into our many incredible resident programs. We install 100% low-flow toilets, showerheads, and aerators in our units. Foundation Communities also has a policy of landscaping with only native, drought-resistant plants to minimize our irrigation consumption. With these standards, in conjunction with robust staff and resident education, we stand at a 15% reduction in our overall water use intensity.

– Waste: Foundation Communities is mindful of the resources we consume and the waste we produce. All of our properties are in compliance with the City of Austin’s Universal Recycling Ordinance, which provides residents with ample access and education on proper recycling. Recently, this ordinance has also expanded to include the provision of composting at our properties. We compost at our main office as well, in addition to diverting hard-to-recycle items like thin plastic, light bulbs, Styrofoam, and batteries through Ridwell. FC’s Welcome Home Luncheon is our biggest annual fundraising effort with over 400 staff and attendees. Our Sustainability Team helps to make this a zero-waste event.

– Climate Resiliency: Foundation Communities formed a Resiliency Working Group this year with the purpose of planning and implementing a myriad of resiliency measures to strengthen our communities in the face of more severe weather and related power outages. We are extremely excited to say that we’ve partnered with the Texas Energy Poverty Research Institute to pilot resilience hubs at two of our properties in North Texas. We will install solar systems at our Shadow Brook and Sleepy Hollow Learning Centers with connected back-up battery storage so they can serve as a place of refuge for our residents in the face of power outages. We hope to learn best practices and standards during this pilot so we can plan how we might be able to build these resilience hubs at all of our communities, eventually.

We hope you enjoyed learning about Foundation Communities’ green initiatives ❤

Happy Earth Day!