Prosper Centers

Prosper Financial Wellness

Program Services

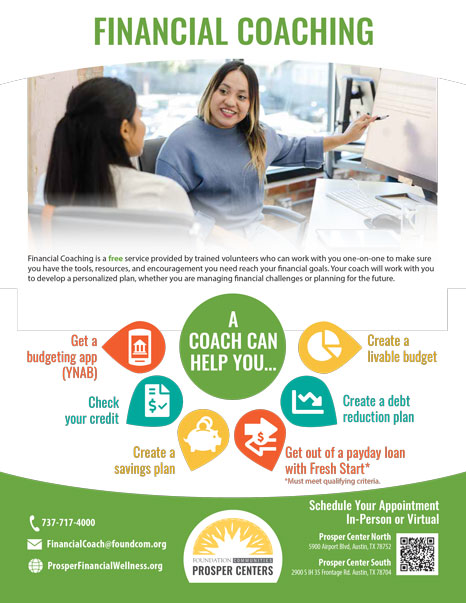

Financial Coaching

Financial Coaching is a free service provided by trained volunteers who can work with you one-on-one to make sure you have the tools, resources, and encouragement you need reach your financial goals. Fresh Start Loan helps borrowers get out of predatory loans such as payday and title loans.

Benefits Assistance

Financial Wellness is excited to launch Benefits Assistance, where trained benefits enrollment specialists will assist people with benefits enrollment and renewal on YourTexasBenefits.

For Foundation Communities Residents

Rent and utility assistance is only available to residents of Foundation Communities housing who have recently faced a financial emergency and have been struggling to make payment. Our rent reporting service is the monthly reporting of rental payments to all three major consumer credit bureaus for inclusion on a traditional consumer credit report.

Financial Coaching

Financial Coaches are available by appointment only. Virtual appointments by phone or Zoom are available on weekdays, evenings, and Saturdays. In-person services available by appointment only at our two Prosper Center locations.

Prior to your appointment, please read our letter of agreement.

One-on-one financial coaches can help with the following:

This is a suite of 14 games and related resources about everyday financial topics. It’s based on FDIC’s award-winning Money Smart program. Play the games here and register your account through our organization, “Prosper Centers.”

Download the English / Spanish version of the Financial Coaching flyer (PDF)

Benefits Assistance

Financial Wellness is excited to launch Benefits Assistance in 2023, where trained benefits assistance specialists will assist people with enrolling and renewing in benefits on YourTexasBenefits.com. Enrolling in benefits can be confusing, especially if you’re unsure if you qualify for specific resources. By meeting with a Benefits Enrollment Specialist, not only will we help determine what you’re qualified for, but we’ll walk you through the application process. Our Specialists are also available to connect you to additional resources as needed.

- SNAP Food Benefits

- Medicaid

- CHIP

- TANF

- WIC Food Benefits

- Healthy Texas Women

- Renew Existing Benefits

Need to apply or renew your benefits?

Please contact us or use the scheduler below to set up an appointment.

Review our list of required documents for your appointment here.

For questions about the program, call 737-249-6394 or email benefitsassistance@foundcom.org

If you do not see an appointment available, please check back again next week. Appointment availability opens up each week.

Si no ve una cita disponible, por favor de volver a consultar la próxima semana. Cada semana se abre nuevas disponibilidades.

For Foundation Communities Residents

Learn about the programs available exclusively to residents of Foundation Communities housing.

Rent Reporting Service

Interested in improving your credit score? Join our rent reporting program!

Rent Reporting is available at the following Foundation Communities properties:

-

-

- Daffodil

- Cherry Creek

- Buckingham

- The Jordan

- Live Oak Trails

- M Station

- Sierra Ridge

- Sierra Vista

- Southwest Trails

- Vintage Creek

- Cardinal Point

- Homestead Oaks

-

-

-

- Build credit without assuming additional debt

- Build credit for something you’re already doing

-

View our frequently asked questions on rent reporting here.

Rent and Utility Assistance

If you live in a Foundation Communities residence and have experienced a hardship or emergency, you may be eligible to receive assistance in your rent and utility bills.

To apply for rent or utility assistance, contact an on-site staff member—such as a Property Manager, Resident Services Coordinator, Case Manager, or Learning Center Manager. You can also call our Prosper Centers at 737-717-4000 or email assistance@foundcom.org.

For more information on rent assistance, click here. For more information on utility assistance, click here.

FAQs

Testimonials

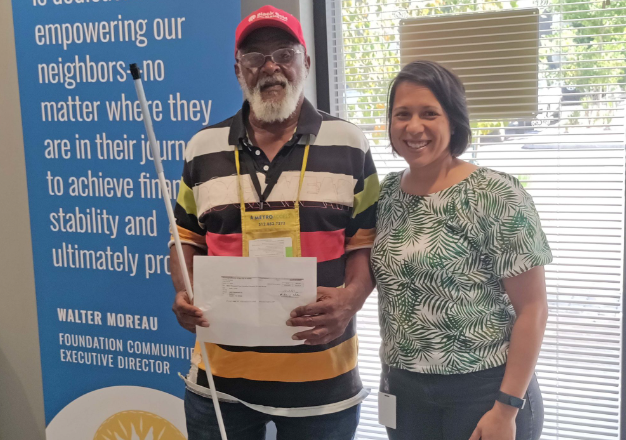

Felix Cook has been meeting with his financial coach since 2015 after being in financial ruin. Over the last seven years, Felix’s financial coach has provided perspective, encouragement, and the time and space to make a plan and Felix has done the hard work of executing the plan. At the end of the day, it’s a team effort. Read the blog post about Felix

With over 1,600 volunteer hours and more than 350 mentees, Miguel Stoupignan has shared his knowledge by teaching financial literacy that leads to a better life. Miguel began in 2013 to volunteer with Foundation Communities and has since then been a financial coach, prepared taxes, and taught money management classes in addition to fundraising for the organization.

Click here to learn more about what the Financial Wellness team has accomplished! (PDF)

Find us on Social Media!

Questions?

Call the Prosper Centers at 737-717-4000.

Meet Our Staff

Julia Pynes, Financial Wellness Program Manager

Lauren Warner, Financial Wellness Program Coordinator

Jessica Valdez, Benefits Enrollment Coordinator

Cesar Siavichay-Diaz, Benefits Enrollment Specialist

Grace LaDuca, Benefits Enrollment Specialist

Alejandra Gavilanes, Benefits Enrollment Specialist