Artist: Jeffery Hollie

Pronouns: he/him/his

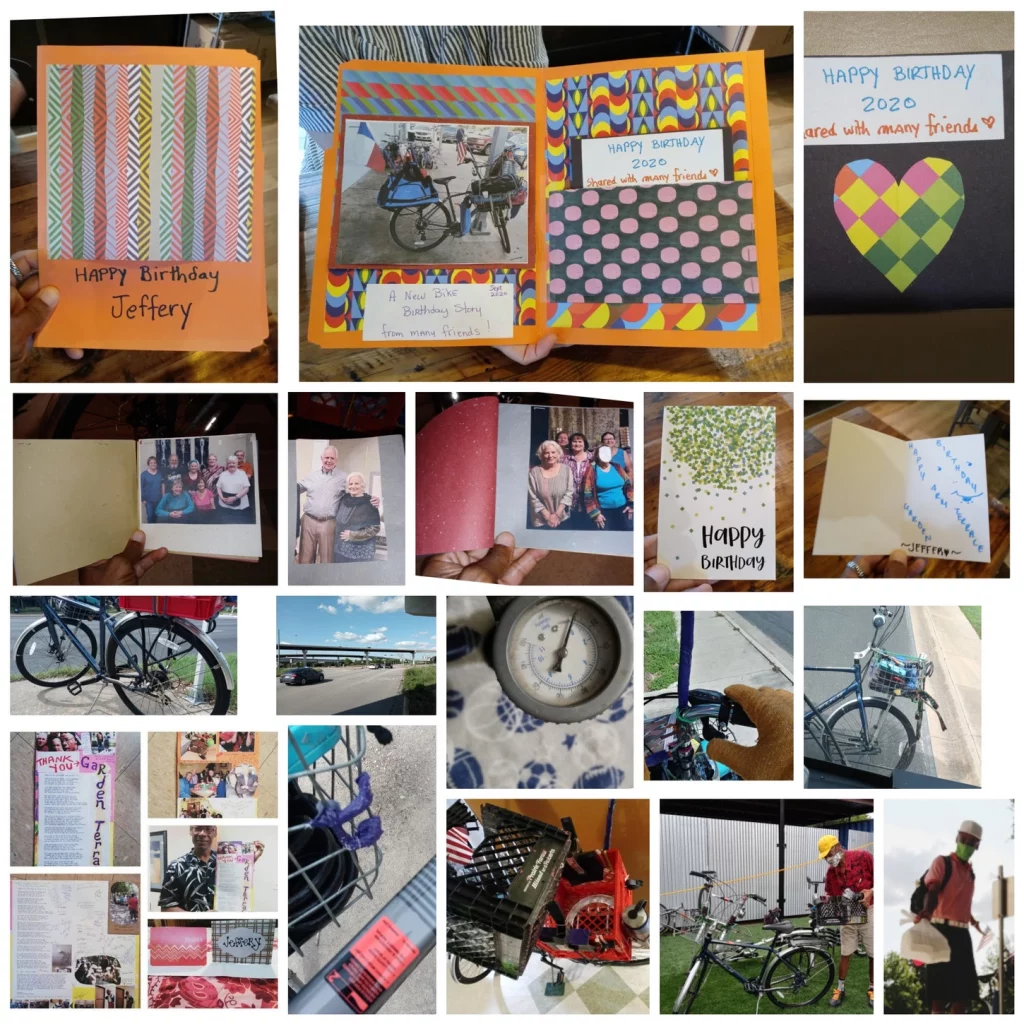

Art Submission(s): Videos, “Jammin’ with a group by P Terry’s”, “Lip Syncing in a Walmart Parking Lot” (no longer available); Photo Collage and article, “My New Bicycle is My Best Ever, Birthday Gift!”

Check out more from this Artist: Youtube: Jeffery Hollie

* * *

Jeffery Hollie really emphasizes the value of freedom in his life and processes, and takes care to find joy in the world around him, as well as sharing that vibrance with others.

We are pleased to be spotlighting Mr. Hollie’s creations in this year’s showcase through digital presentation, and an interview about his creative processes, experience, and thoughts on creation and culture.

Visit Jeffery Hollie’s YouTube page to check out his available work there

Photos of Creative Works

The photo, adding to the shirt from another short, too small, is to keep the orange, flowered shirt, from coming out my pants on certain parts. That gray cloth is working. The shirt is staying in my shorts better. I think that’s creative. That was done 9-19-20.

The photo of me by my new bike, has this theme. I like dressing colorful. Additionally, friends just bought this new bike for me as a birthday gift. I was putting the basket on my old bike on it. That was temporary till I acquired a red basket, that contrast the dark blue bicycle better.

My New Bicycle Is My Best Ever, Birthday Gift!

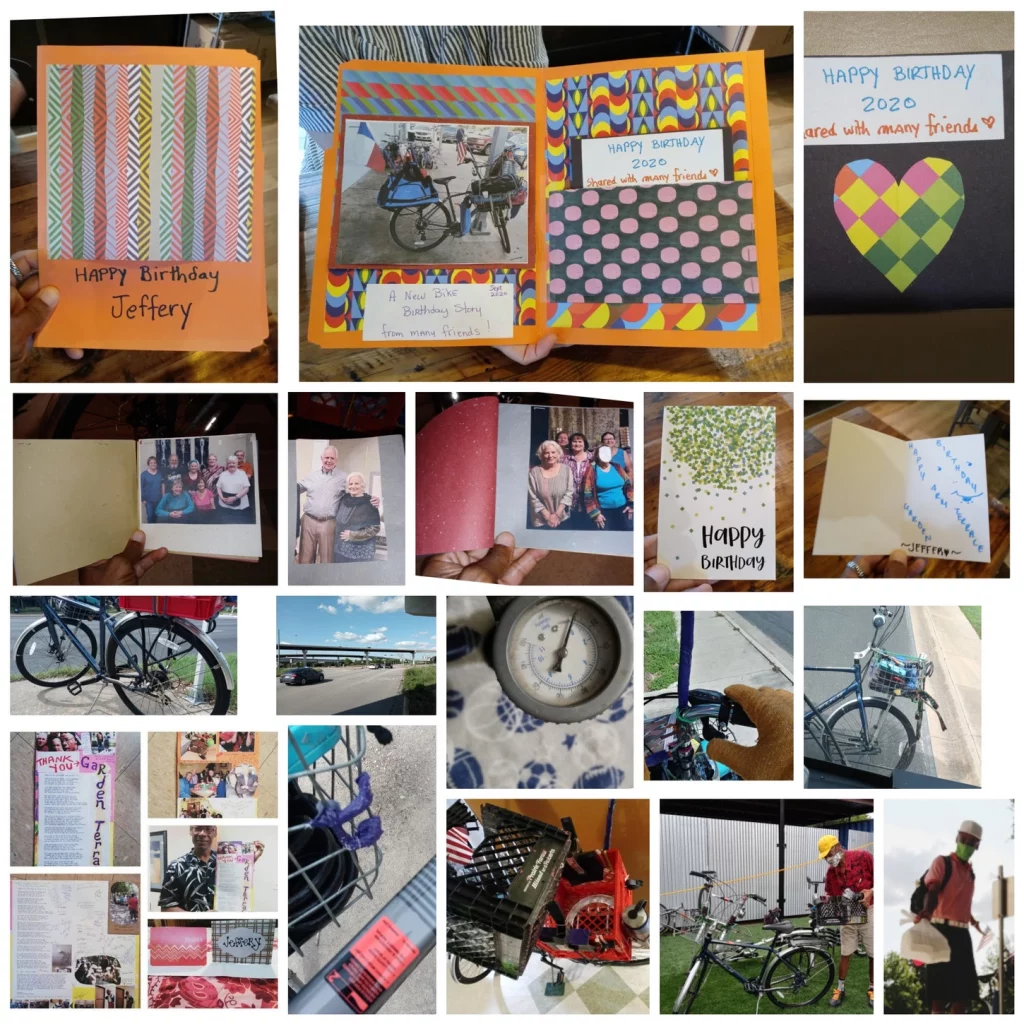

Today, 9-13-20, at Lil Doddy’s, my friend Carmen, treated me to lunch. I deemed it, a pre-birthday gift meal. Additionally, she gave to me a birthday card that she made. I thanked her for it, and for the hard work she put into it. Thanks for the meal too, Carmen. I chose a burger, as often before.

THE TOP ROW, FAR LEFT PHOTO, is the outside of the card. COOL! MY NEW BIKE IS SHOWN! That’s created. I told her, “You know how to do this, because you’re a former school teacher.” THE MIDDLE PICTURE is the inside of the card. The back is solid orange. THE FAR RIGHT PHOTO ON THE TOP ROW, IS A PICTURE BOOK THAT OPENS, contained in the pouch area, dotted part shown. This is an ingenious card! Photos of her friends, and mine, are inside of that picture book.

THE FIRST THREE PICTURES ON THE SECOND ROW, is some of the friends of Carmen and myself, she’s introduced me to, inside that flip open Picture Book. I only chose three pictures in this photo collage. I respected one person’s privacy. Carmen’s husband, Murray, is shown, with her. She told me these friends all partook in helping with the cost of the new bicycle! Wow! I’ve heartedly THANKED THEM ALL! Initially, I was going to pay a part of the price, but some of these friends wanted to make sure I didn’t pay anything. That was nice of them!

THE LAST TWO PHOTOS TO THE RIGHT, ON THE SECOND ROW, is a card from my apartment, Garden Terrace. They yearly acknowledge the birthdays of residents. And in my apartment, in this vein of thought, I told Carmen her card reminded me of a thank you card I made for my apartment when they installed free WiFi for us (2014). THAT CARD IS SHOWN IN THE FAR LEFT PICTURE, BOTTOM ROW. And just like former staff, Sofia, kept my card in her office, so I’ll keep, and treasure Carmen’s work of labor, for my BIRTHDAY!

IN THE THIRD ROW, more photos of my new bike are shown. The PHOTO OF THE RIGHT GEAR SHOWN, depicts how I’m enthused that the gears numbers are directly facing me. On other bikes, I don’t recall them being exactly that way, though on some bikes, they may have been.

The Second Picture, Third Row, is the OVERPASSES ON HYWY 290, BY WALMART IN SUNSET VALLEY. I took that photo to go with others, for another photo collage about Austin’s overpasses. Carmen told me, going left on W WILLIAM Cannon, down Mopac, will get me to that Walmart. I was in search of short ink pens for shirt pockets that aren’t deep enough for regular size pens. They didn’t have any. But they had popcorn I ran out. Since part of the Mopac service road didn’t have sidewalks, in the car lane by the sidewalk, I stayed. Cars went by me in the two other car lanes, as I rode my bike, and looked over my shoulder. I soon came to trails and sidewalk. I didn’t go back that way to William Cannon, when someone told me the other direction, I asked of, goes to William Cannon. I’ve been to the end of Brodie, but just not all around that Walmart. I cut off an ink pen, shortening it that way, and searching for something for my old bike receipt in the apartment, I found a short pen. Cool! I’ll just put the three possible years I bought that bike in these comments.

The PHOTO OF THE BIKE PUMP conveys this: I was seeing too much give (about halfway bent down) of the back tire. Therefore, I put more air in the tube. But I didn’t want to exceed where I’d gone, to not burst the tube. However, the weight on the bikes’s back tire, demanded more air. THE FAR RIGHT PICTURE ON THE THIRD ROW, has this theme, all of a sudden, my new bike is leaning forward too much, on bus bike racks, even more than the last bike. I thought, “Maybe that’s so, because the wheels on this new bike are more slender, and not touching the guard good enough.” But many of the bike rails on the old buses are bent forward. Anyway, whatever the reason, I’m hooking a bungee cord from my bike basket to the bus guard, that comes over the bikes’s front wheel. Before I commenced this, I did it with a string, initially. But prior to not doing this, on bus rides, though the bike was rocking, leaning and moving, thankfully, it didn’t fall off. With the 801 Rapid bus, there’s a different bike rack setup, where a hook comes over the front tire. I’ll put the hook through a string, hanging from my bike basket, SINCE THE RAILS ON MY BASKET PREVENT THE HOOK FROM MOVING FAR ENOUGH OVER THE TIRE. THEREFORE, THE HOOK SLIDES BACK FROM TIRE PROTECTION. THEN I THOUGHT OF PUTTING A CIRCLE IN STRING FORM ON THE BASKET FOR THE BUS BIKE RACK HOOK, TO GO THROUGH, AS WELL OVER THE TIRE. MY STRING HALTS THE SLIDING BACK OF THE HOOK. I PERCEIVE WHEN I BOARD THAT BUS, THAT WILL WORK FINE on this new bike. As I told someone, “I’m the black MacGyver!” And someone told me, “… You’re resourceful.” And I’ve also said, “I use a lot of things for what they’re not made for.” An example: a picture frame, I use as a partition between my backpack and lip sync signs, to keep my backpack from bending them, in my back bike basket, as I bike about.

UPDATE: I rode on purpose, the 801 bus today, 9-14-20, and my circle was not big enough for the hook to reach my circled string. I got off downtown and made the circle larger, and the hook on the next 801 bus rack, back south, fit perfectly through my extended loop, and around the tire. My bike is also, more stable on the 801 bus bike rack.

The SECOND PHOTO, FROM LEFT, ON THE BOTTOM ROW, has this thought, Bob, who at Bike Farm, worked on my new bike, noticed how, when I turned the front wheel, and turned it back again, a corner of the basket scratched up the bikes’s body. He quickly devised taping up the area on the basket. I’ve monitored the area, and put more tape, as I needed. I don’t want to scratch up a brand new bike.

THE MIDDLE PICTURE ON THE BOTTOM ROW, CONTRAST how better looking is my new red basket from my old black one. Since my bike seat, on my former bike, wouldn’t tilt back far enough, BECAUSE THAT BLACK BASKET WAS IN THE WAY, I asked our maintenance guy to cut a section out of it. That made my day! I could move the seat backwards. You see, I don’t like sliding off bike seats, and constantly scooting back on them, fully. On this new bike, when the seat was level, I asked a staff at Bike Farm to adjust it backward. And I just got half of the screw left, in this type of bike seat post, but the seat is holding firm. For awhile, with the former bike, with this top of seat post, I was trying to get the appropriate screws, but longer. I couldn’t find them in a few places I went. It’s the type of seat post, where you can run out room, as you have to turn screws opposite ways, to adjust the seat. As long as I’m sitting firm, with half of a screw in one hole left, no worries, though I didn’t want that type of seat post. It’s working though. And I donated to Bike Farm a kickstand, that has two legs, where my old bike fell, on right or left positioning of the front of the bike. As I told someone, “It’s not made to take the weight I have on bikes.” Part of my happiness for the new bike led me not to try to sell them the kickstand, as I aspired. I had my basically new seat transferred from my old bike to the new one. And I’m glad Bob put the same kind of kickstand on this new bike, I had on the former bike, but a new one. Because, as I told Carmen, the other one, that is, part of it, kept moving out of place, and that bike kept trying to fall, and wouldn’t stay up, unless I kept readjusting that kickstand. That probably would have occurred on this new bike, if he’d used it. However, I asked him to cut an inch off the new kickstand, since it was falling on level ground. It was too high. That cutting off an inch, gave the bike the perfect tilt downward, to not fall, when the handlebars are turned to the right, when the kickstand is down. Additionally, a good thing about the bike basket rack, it’s long enough to not prevent the seat from being adjusted back. Moreover, before throwing it away, I took a picture of the old basket, that a part was cut out, and that part too, I took a picture, to commemorate how I appreciated that from that guy.

The FOURTH PICTURE TOWARD RIGHT, ON LAST ROW, show me at Bike Farm, transferring my former black basket to my new bike, before I acquired the red crate. Buy the way, in the Re-Store, the only crate I could find, was the red one, which had in it many items for sale. I took it to the cashier and said, “I don’t want to buy all this. I need only this crate….” He told me to wait, and came back with a black crate. I told him, “I don’t want a black crate.” I assumed wrongly. But when he reached me, he poured the items from the red crate into the black one, and gave the red one to me. I asked, “What’s the price?” He said nothing, and I can have it. I was enthralled!!! I thanked him. You see, I wanted different contrasting colors on this new bike. My carry bag, on a clamp, is bending the red crate, thus I’ll think of something.

THE FAR RIGHT PHOTO ON THE LAST ROW, portray this message, after Carmen’s lunch with me, as I was getting ready to leave Lil Doddy’s, a staff offered me some food, I perceive, someone ordered and left or didn’t want. I thanked her. I’ll consider that, part of birthday blessings. I later saw it was three burgers. Upon later eating one of the burgers, I first removed the bacon, since pork gives me a headache.

My new bicycle, from a distance, may look similar to my old one, since I had my high handlebars transferred over, baskets and my horn holders (made from a sweatshirt arms) hang from the front basket), but it’s obvious it’s a new bike. And I asked Carmen if the two pouches hanging on both sides of the front basket, make it ugly. She said no. I added they house my prop sax and horn, to be assessable for when those music parts come up in songs, to mimic the blowing, on the spot, even at intersections, waiting on green lights, as often I do.

My last bicycle was a GT, I bought 2012, 2013, or 2014, from Top Cash Pawn that was on South First & W William Cannon, but they moved to Congress. The new bike is a FUJI, that these great friends got me from Bike Farm, on Burnet Road, I chose to go, taken in Carmen’s car. It was bought 9-4-20, and picked up the next day by me. At first, I chose another bike store, but I’m glad I switched to Bike Farm. One staff, that jotted my orders, took photos of my new bike. I assume he’ll put some of them on their site? Cool! I thanked Carmen for initiating and orchestrating this early birthday gift, when I was determined to patch up the old bike or transfer my parts on a used GT bike I foraged for. I’ve been acquainted with my good friend Carmen and her nice family since about 2014 or 2015, or so. Additionally, she’s introduced me to some of her great friends!

When lately, the calf on my right leg, became sore, I mused how it could be from this new bike, being too hard to peddle. But on second thought, as I’ve rode it, a few days after that thought, this new bike is peddling as a bike typically suppose to peddle. Relative to the gears, as I move to easier, it’s more easier to peddle, and the same is true, in harder gears, for downhill. It’s just that I want it to peddle too easy, as when I began riding bicycles again, after a long prison stay. THANK GOD I’M FREE, SINCE 3-20-2008, after 32 years incarcerated!!! My calf is better, and that slight pain could have been from another source, though I don’t recall bumping into anything.

I AM REALLY ENJOYING THIS NEW BICYCLE! AND I CAN’T WAIT TO GET BACK ON IT EACH DAY! THANK YOU ALL AGAIN, FOR GIVING, TO GET IT FOR ME!

A FEW EXAMPLES OF MY THANKS AND REPLIES:

To: Renee G…

“Thanks my friend, for pitching in for my new birthday bicycle! Thanks also, for making sure I didn’t pay the fee I was going to pay! Love this bike! I think it’s the best birthday gift I’ve ever had, esp. since I was starting to have issues with my old bike. I had bike shop to transfer my handlebars.”

Her Reply,

“Hi Jeffery. You’re so welcome. You deserve a new bike. Thanks for the great pics! We all love you “

To: Henry…

“Thanks Henry, for pitching in, to help get my new birthday gift bike!…”

His Reply,

“You’re welcome Jeffery! Great looking bike, I know your enjoying it – glad I could be part of your Birthday! Take care & God Bless you, hope to see you soon”

I love these responses, and the others, to my thank you texts!

My 64th Birthday is 9-27-20 (if God’s willing), and I’m thankful for this early birthday gift! And Carmen, you hit the nail on the head, when you told someone my bike situation needs to be resolved, since it’s one of my primary means of transportation. I agree. My bicycle is my car, since I never learned how to drive a vehicle. I don’t think that tractor on a farm count, since no driver’s test occurred, nor was there city streets on that farm.

I began this photo collage about 9:35 PM, 9-13-20, and proofreading, and additions, were completed 9-14-20, at 5:50 PM.

From my book, Pictures With Comments, And Poems (The Sequel).

© 2020

Jeffery B. Hollie

We’ll start with describing your creative work/practice: What tools do you use? Do you have a routine?

Currently, I’m unemployed…

Three fourths of my life, I’ve been incarcerated in corrections facilities. The impact is, I appreciate and value FREEDOM more.

What does your work aim to say? Why do you create?

My lip syncing shows my creativity in music enjoyment. I feel it’s entertaining and innovative.

Who/What are your biggest influences? Who/what inspires you?

John Bunyan, from the 1600s, my inspiration to be a writer.

How have you developed your practice? What challenges and opportunities have you come across? How has your practice changed over time?

I try to get better in lip syncing. I’ve made less signs, and enacted with gestures in their place, in public, put signs on my bicycle, no longer using city poles, etc.

“My lip syncing shows my creativity in music enjoyment. I feel it’s entertaining and innovative.”

What are you most proud of? Why?

I’m proud I’ve been able to stay out of prison since 3-10-20, twelve years, 6 months, & 11 days, to the date of 9-21-20. By the way, it’s also my brother, Ronald’s birthday. I wished him Happy Birthday on a phone call. My birthday is this coming Sunday, 9-27-20. And I’ll add, I’m proud of God letting me reach 64.

What is your dream project?

To perhaps write a classic novel. To continue lip syncing, as no other, to my my knowledge.

How do you share your creative practice and with whom?

I give my lip sync cards to others, which include typing in my name, Jeffery Hollie, into YouTube’s search, to see me. Along with my lip sync videos, I have other type.

Has living at Foundation Communities impacted your practice? If so, how?

I began being created in this music hobby I’m describing, since I’ve been here, since 9-4-09. If I’d lived anywhere else since 8-4-09, as here, I feel I’d be about the same, musically. But staff here, on some events, has asked me to do my act. I enjoyed lip syncing, and I gathered, some of the crowd liked it too. Other residents sang for real, and played instruments.

What art/culture trend do you love right now? What trend do you wish you could forget?

As I’ve said, my lip syncing is my type of arts/culture at the moment. I think I’m the only one in the world, lip syncing this unique way. That’s not bragging in the wrong way, but I’m glad to see in me, that it’s INNOVATIVE.

As I’ve said of it, “I did not say, I’m going to go out, and try to lip sync like nobody has done. I was just having fun! Then later, I noticed it was different. But I still lip sync as others, without props and signs, etc.'” Online I haven’t seen any but me lip syncing with music props, mimicking music props I don’t have, pointing to words (I’ve put on signs) as those words are sung, acting out other words, without signs, dancing to the way an instrument is played, dancing in a way to emphasize background singers, etc. As I’ve often said, “I try to do something with everything in a song, as I lip sync, and act it out.”

At karaoke, before I stopped going, a man seeing me a first time said, “I’ve never seen that in my whole life!” Though it wasn’t karaoke, the DJ let let me regale there. And after, James would close me out, “That’s Jeffery, with his brand of karaoke.” One regular there, who liked it, said, “That ain’t easy what you’re doing. But I said, “I feel anybody can do it.” At times I tried singing for real, and I sounded horrible to me, though some gifted singing friends told me I didn’t sound bad.

I don’t recall a trend I want to forget.

Additionally, writing, I feel is my art/culture.

What delights you? What brings you joy?

Trying to enjoy life daily. It delights that I’m free from prison! My favorite songs bring joy! Riding my bicycle brings happiness. Writing books and poems rejoices me! Eating good food, and nice snacks as popcorn gladdens me!

What is the best piece of advice you’ve been given?

Control anger and stay on the outside. In a card my sister, Terri, sent me, she gave me that advice, in 2013.

What is the worst piece of advice you’ve been given?

Do you want to buy this and that, and once a man tried to give me $100 for my Texas ID. In those cases my reply was NO. That’s more of selling and trying to pay for something.

What piece of advice would you like to give?

Continue to reach for your dreams and stay out of trouble.

What’s your favorite way to celebrate?

Anything that’s good!

Mr. Hollie takes time to appreciate the details in life as well as the creations around him. “Riding my bicycle brings happiness. Writing books and poems rejoices me!”

What’s your favorite book/piece of writing, song/album, movie/TV show, play/live performance, piece of art, food/drink, place, or animal?

The Bible’s #1, then my #1 novel is The Pilgrim’s Progress, by John Bunyan. I first heard it on a play, on the Christian radio station, KHCB FM, in Houston, TX, in about 1980. Thereafter I wrote Christian friends, requesting they send it to me? I periodically repost my tribute poem of it on my Facebook page, which covers the highpoints of Christian’s journey to The Celestial City. The book’s theme is a journey from this world, to Heaven. I like a lot of sports’ pieces of writings. If I had to choose a favorite song, it’ll be Lady You Are, by One Way. I could have chose another song, but it first came to mind for this query. I’ll go with Thriller by Michael Jackson, as my favorite LP. Terminator 2, I’ll choose as a favorite movie, but I can put The Pilgrim’s Pross DVD movie a tie with it, and it’s play (if there’s one), is my favorite. I don’t have a favorite piece of artwork. Ironically, when younger, I used to draw pictures, but that faded from my life. Maybe Orange Juice is my #1 drink, and Fried Chicken my #1 meat. Dogs I like best, though I don’t own a pet.

What’s the first thing you do when you wake up? What’s the last thing you do before going to bed?

Basically, GO, since my bladder is overworked. Tried pills, from urologists, but no more, since they all give headaches. Prostate pills don’t work. Scared to try the Botox bladder shot, because of side effects I’ve read. For now, I go frequent and if I can’t make it to a Men’s Room, I go in the diaper, a friend told me of. I’m not ashamed to share this that is common in older males. That’s an extension of what I first do when I awake, and at times, several times, prior. Hopefully, one day this is fixed. Next, I thank God for another day, then breakfast, etc.

I feel it’s important. Each person has gifts, etc., that can help, entertain, etc., others.

Something that’s really important to you that has nothing to do with your work:

Sleep. I need to sleep better. I’m getting by on 3 or 4 hours and naps each day, maybe less or more. But I’m grateful for that. I like to get a GED one day.

What role do artists and culture-bearers have in society? What role could/should they have?I feel it’s important. Each person has gifts, etc., that can help, entertain, etc., others.

What do creatives need in order to thrive? What do you need in order to be creative?

They need to figure out what to do better.

What was the last thing that made you: Laugh? Cry? Blush?

Looking at myself dance in the mirror, to a song tonight, 9-21-20.

What are you really into right now?

I’m into music, sports.

Looking at myself dance in the mirror, to a song tonight, 9-21-20.

I’m trying to take it one day at a time.

One thing/person/idea/group/event/place/etc. everyone should know about:

What they feel is best for them. Everyone is different.

Who is an artist? What does it mean to be creative?

I assume, entertainers, writers, painters, and anyone good in other professions.

What is culture? What does it mean to be a culture-bearer?

The dictionary says of culture, “the arts and other manifestations of human intellectual achievement regarded collectively.” That’s the first time I looked that word up. So, I surmise a culture-bearer is someone with a worthy accomplishment or trait, skill, that’s helpful to others. And I just looked culture-bearer up, and it is someone who does more good than harm. …

What question didn’t we ask that you wish we had? What question do you have for other artist, creatives, and culture-bearers?

I sense you covered enough questions, adequately. I can’t think of any to add. Maybe the artists, etc., could befriend likeminded people for support, advice, etc.

Anything else?

The interview queries provoked me to seriously think for the best possible answer.