“I think for a lot of single mothers like me, it’s really, really helpful. We have no other source of income other than our job income and, with prices going up it’s even harder.” That’s what Sheila, a Prosper Tax Help client who is a mother of four, said about receiving advance Child Tax Credit payments. She said after using Foundation Communities’ free tax services several years ago, she started filing her own taxes because they were simple. Then, changes in the tax laws, especially the Child Tax Credit, convinced her to return to Prosper Tax Help. “For the Child Tax Credit, I just really like that ya’ll are up to date with everything, and ya’ll do your best for everyone to get their max tax [refund] and Child Tax Credit. It’s just worth coming here, I feel,” said Sheila.

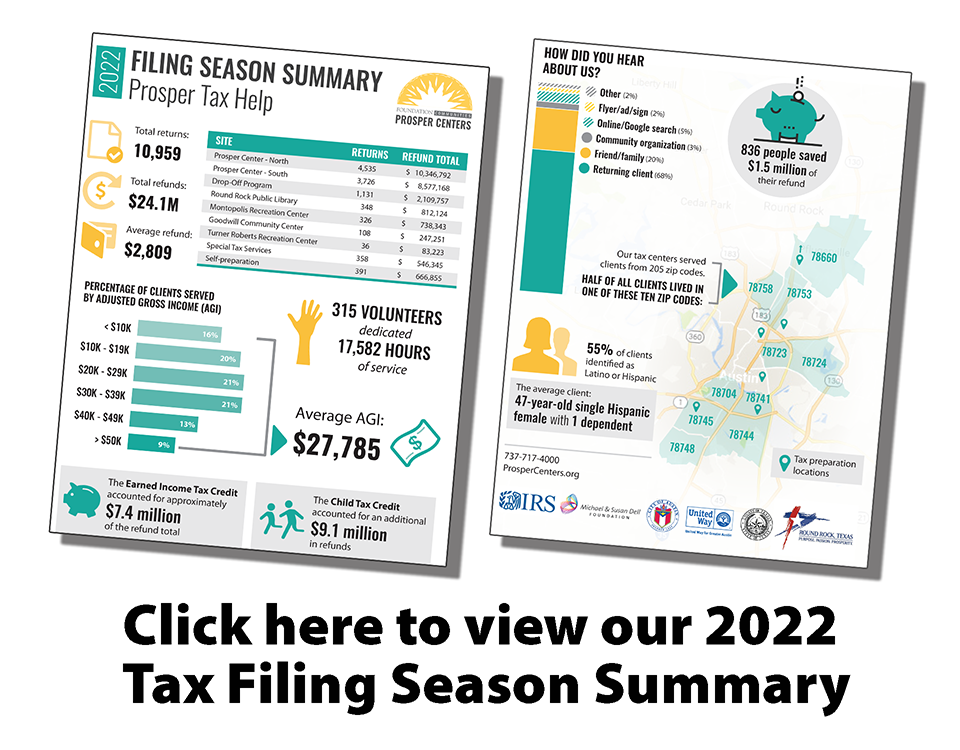

Until October 15, Foundation Communities’ two Prosper Centers in Austin will be open on Tuesdays and Thursdays, as well as some “bonus” days, to assist our neighbors who still need to file their taxes. Many of them have not received the Child Tax Credit they are eligible for because they haven’t filed a 2021 tax return yet. Our IRS-certified tax professionals are also helping clients access stimulus checks they have not received, respond to letters from the IRS and apply for, and renew ITINs (Individual Taxpayer Identification Numbers).

Sheila says before Prosper Tax Help filed her taxes in January, she was concerned that the advance Child Tax Credit payments she had received would reduce the amount of her tax refund. She was relieved when her refund was not affected. Sheila also talked about how the Child Tax Credits helped her as a single mother. “Like, my baby, I paid daycare,” said Sheila. “We were able to also buy some new clothes or go out to eat to Mr. Gatti’s, especially for the baby so he can have fun.”

Sheila says she has paid to have her taxes done before, through for-profit tax services. Not only did she not like having to share some of her refund with those preparers, she also didn’t feel comfortable about it. “When I’ve paid, I always feel something’s suspicious or hidden. I don’t get my questions answered and I do ask a lot of questions,” said Sheila. She says at the Proper Centers she always gets her questions answered and she likes the way returns are double-checked to make sure they’re done correctly. She says she often recommends Prosper Tax Help to others.

You can learn more about receiving free help with your taxes through Prosper Tax Help at prospertaxhelp.org.